Description

This HFT Robot is a Forex EA for Passing Prop Firm Challenges. This expert advisor (EA) is specifically crafted to excel in the rigorous evaluations and challenges set by proprietary trading firms. In this article, we explore the features and benefits of this EA, particularly in the context of passing prop firm challenges or evaluations.

Designed for Prop Firm Challenges:

The HFT Robot is meticulously engineered to meet the strict standards of prop firm evaluations that allow high-frequency trading (HFT). Its primary purpose is to help traders pass these challenges or evaluations with success.

Efficiency in Achieving Targets:

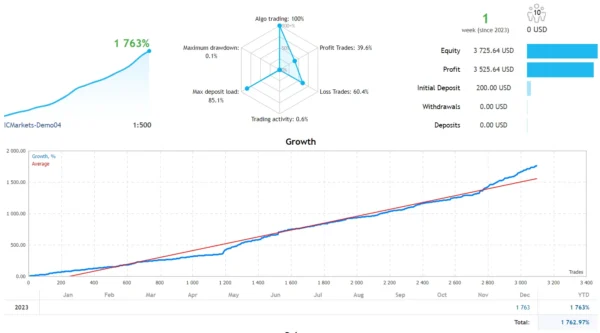

This EA is designed to meet challenge targets swiftly, often in a short timeframe. What makes it unique is its ability to maintain a low drawdown, an essential factor in the high-stakes world of proprietary trading.

Advanced HFT Strategy:

At the core of this EA is a specialized HFT strategy that identifies significant market movements. This enables the EA to capitalize on these movements with precision and speed.

Robust Risk Management:

One of the EA’s key features is its stop-loss mechanism, designed to protect equity from unexpected market fluctuations. This risk management tool plays a critical role in safeguarding the trader’s capital.

Equity Protector:

The EA includes an equity protection feature that automatically halts operations once the target is reached, securing profits and protecting them from further market volatility.

Innovative Money Management:

The EA features a pro-ratio money management (PRMM) system, which automatically adjusts lot sizes based on gains. This helps to speed up challenge completion while minimizing drawdowns. Traders also have the flexibility to enter lot sizes manually if preferred.

Market Condition Sensitivity:

Recognizing the need for timing in HFT trading, this EA is designed to operate during active market conditions. This strategic approach enhances its ability to pass prop firm challenges quickly—sometimes in less than an hour.

Non-Martingale or Grid System:

Unlike other trading systems, the HFT Robot does not employ a martingale or grid strategy. Instead, it follows a disciplined approach, opening one trade at a time and ensuring each trade is closed before initiating another.

Trade Management:

The EA’s disciplined approach involves opening and closing trades sequentially, with each trade protected by stop-loss settings. This further emphasizes the EA’s commitment to effective risk management.

It is important to note that the HFT Robot is intended for use exclusively in HFT-allowed prop firm evaluations and challenges. It has not been tested for other types of trading challenges, funded prop firm accounts, or live/real broker accounts. This highlights its specialization in a specific niche while acknowledging its limitations in broader trading environments.

Achieving optimal performance with this EA depends on favorable trading conditions. To maximize results, traders will need a broker with low spreads, minimal slippage, fast execution times, and a low-latency Virtual Private Server (VPS).

Demo Testing Recommended:

It is recommended to test the EA in a demo account for at least a week before using it in a live account. Ensure that you fully understand how the HFT EA operates before applying it to real trading scenarios.

The Forex Geek (verified owner) –

The HFT EA is praised for its self-learning Neural Network algorithm and its ability to predict high/low prices of future H1 bars.

GregMitch68 (verified owner) –

Being completely new to trading I’ve been looking at some of the most popular EA’s on the Forex Robot Store . The Pass HFT EA is one of the most popular. It seems to work well on Demo accounts for winning challenges but can it be used in a serious way for trading on MT4 ? I don’t want to use it for winning challenges but just use it for trading myself with my own funds. Has anybody used this with any success ? Can it even be used to trade in your own account ? Or is it only designed to win challenges for prop firm accounts ? Cheers

Rahul (verified owner) –

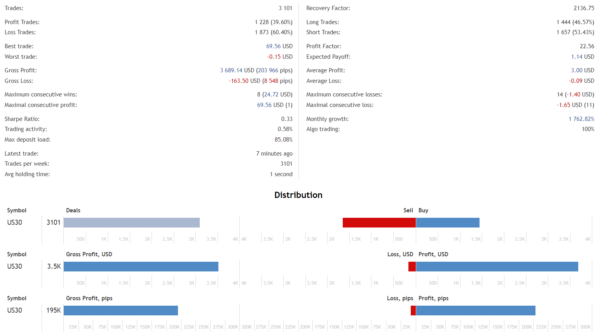

This EA is highlighted for its high-frequency trading tactics, advanced algorithms, and customizable settings for US30